Health News

28 seconds ago

Olivia Munn is going through medically induced menopause after breast cancer treatment. Here’s what that means.

Olivia Munn is in medically induced menopause as a result of treatment to keep her breast cancer from recurring, the actress told People in an exclusive new interview. Munn, who last month revealed she’d undergone a double…

Health News

12 hours ago

Wanna flex your green thumb this season? According to a professional gardener, you should have these 11 tools on hand

I write about home and kitchen products for a living, so if you’re looking for a new vacuum or air fryer, I’m your gal. But I’ll be the first to admit that when it comes to gardening,…

Health News

1 day ago

Melatonin bottles are easy for young kids to open. New guidelines could change that.

After thousands of children wound up in U.S. emergency rooms after accidentally ingesting melatonin, a major supplement industry group has issued new safety guidelines, which include asking makers of the popular sleep aid to use child-deterrent packaging.…

Health News

2 days ago

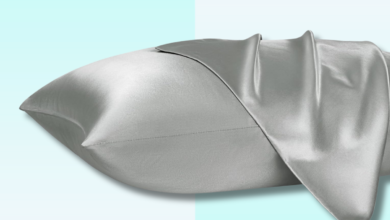

These bestselling satin pillowcases have nearly 225,000 five-star reviews — and they’re on sale for $6 a pair

With so much of our lives spent in dreamland, having great bedding is a must. So imagine our delight when we found a set of pillowcases that will not only make your bedroom look and feel more…

Health News

2 days ago

How to stay safe during heavy rain, lightning and tornadoes

Storms sweeping across the central U.S. beginning on April 15 could inundate as many as 40 million Americans with large hail, high-speed winds and even tornadoes, meteorologists warned Monday. Weather — from heat to cold to tornadoes…