Former Treasury Secretary Robert Rubin condemns threats to default on U.S. gov’t debt

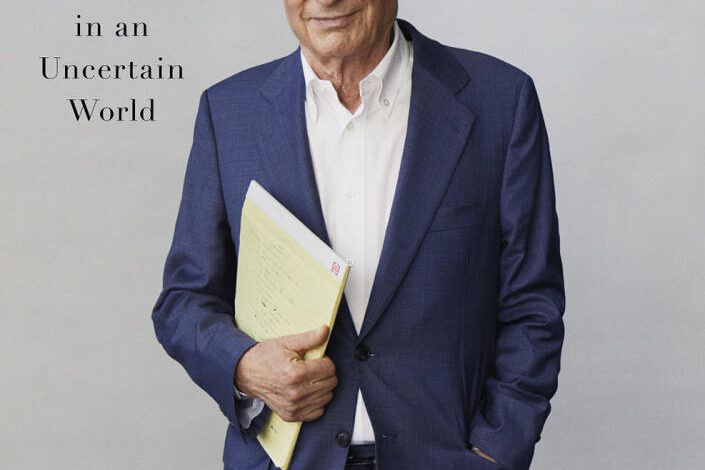

Former Treasury Secretary Robert Rubin, author of the new book “The Yellow Pad,” and, perhaps most important, veteran of the debt ceiling wars, offers a commentary about this past week’s debt ceiling showdown in Washington:

In 1995, I was the Secretary of the Treasury when members of Congress threatened not to raise the debt limit until the president agreed to their policy demands. Thirty years later, we just went through another debt-ceiling crisis.

This is a pattern we can, and must, break.

I’m proud to have served in an administration that balanced the budget. And I’ve been concerned about rising debt and deficits in the years since.

But creating a crisis over the debt limit is dangerous and irresponsible.

Consider what raising the debt limits does: it allows the Treasury Department to make payments on already existing debt. It does not authorize any new spending. It’s not like buying something on a credit card; it’s like paying your bill after you’ve already bought something on a credit card.

As everyone knows, if you don’t pay your bills on time, it’s more expensive in the long run, and your credit score goes down.

It’s the same for countries. If Congress refuses to allow the United States to make payments on its existing debt, in what’s known as a “default,” the economic consequences would likely be severe. It could send markets falling; raise costs for car and home loans; and hurt America’s standing around the world, among much else.

Biden addresses nation on debt ceiling deal to avoid default: “This is vital”House passes debt ceiling deal and sends it to the SenateWho voted against the debt ceiling bill in Congress, and who voted for it?

We avoided default this time, and that’s a cause for relief. But there’s no guarantee we’ll be similarly fortunate in the future – and the more of these crises we go through, the greater the chances that one of them eventually leads to severe economic harm.

Threatening to force the United States to default on its debt is risky and irresponsible.

Debt ceiling showdown “was incredibly costly” to U.S., economic expert says (“Sunday Morning”)

Going forward, lawmakers should stop using the threat of default as a bargaining chip, and use the normal Congressional budget process to deal with issues of taxation and spending.

That way, we can get our house in order without putting our entire economy at risk.

For more info:

Robert E. Rubin, Council on Foreign Relations“The Yellow Pad: Making Better Decisions in an Uncertain World” by Robert E. Rubin (Penguin Press), in Hardcover, eBook and Audio formats, available via Amazon, Barnes & Noble and Bookshop.org

Story produced by Robert Marston and Young Kim. Editor: Carol Ross.

CBS News political panel on what voters can expect as GOP race for president intensifies

Bank of America CEO Brian Moynihan says “it’s not good” for U.S. to fight over debt ceiling

Good news about job market comes with possible economic headwinds on the horizon