One in four gyms in Spain was founded less than a year ago

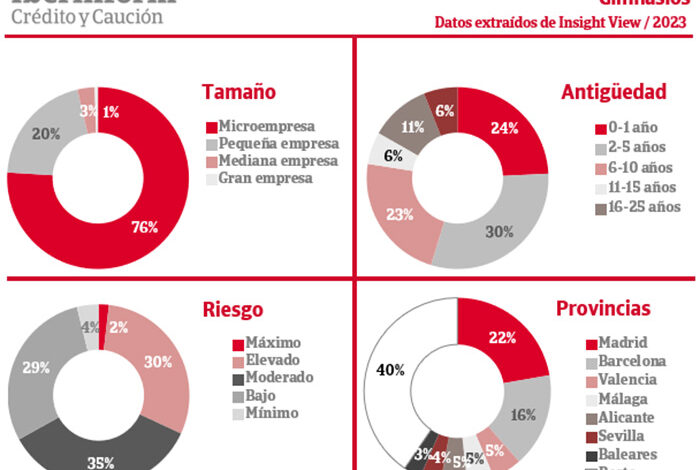

The record number of new gyms inaugurated in Spain during the past 2022, in which 300 new businesses were touched, has given way to the curious fact that 24% of the global companies that currently operate in the sector do not even have a full year of experience.

A much higher percentage than that shown by other sectors of economic activity and which shows the strong exponential growth that this sector continues to experience, despite the blow caused by the pandemic.

However, according to the data offered by the Insight View analysis platform, despite the proliferation, the credit risks of these companies would also be very high. Specifically, 32% of gyms would now present a maximum or high risk of non-payment. These are two percentage points above the values registered before the pandemic, which accounts for the bill that the outbreak of Covid19 and its management has left in the sector.

More companies, but less solid

The worst financial performance is recorded among those gyms that have been founded in the last decade. High default risks affect 35% of companies in this segment. In companies between 10 and 25 years old, this ratio drops to 20%, and stands at 23% among those over 25 years old.

Valencia, city with the highest risk of non-payment

Madrid (22%) and Barcelona (16%) are the provinces with the most gyms, according to Insight View. Taking into account the provinces whose weight represents at least 3% of the sector, the ratio of companies at maximum or high risk of defaulting on their payments is above average in Valencia (43%), the Balearic Islands (37%), Madrid ( 36%).

On the contrary, the best ratio is registered in Alicante (20%), followed by Seville (31%), Malaga (33%) and Murcia (33%) and Barcelona (33%).

Atomization persists

For its part, the distribution by business size shows the fragmentation of a sector where the presence of large and medium-sized companies is testimonial: 76% are micro-enterprises, a percentage that rises to 96% if small ones are also added.

“The aggregate analysis of the official accounts presented by these companies shows the reality of a sector that works with a high dependence on external financing, which represents 72% of its total financing sources, but with a high quality of debt , since only 28% of its third-party funds mature in the short term ”, they assure from Crédito y Caución.

Thus, the study of the accounts of the almost 2,000 companies that make up the sector prepared with the Insight View tool shows how the segment, which had managed to stabilize its margins in 2018 and 2019, has been facing a general deterioration in its profitability ratios since 2020 .