Xponential Fitness Weathers Negative Report But Forward Indicators Are Worrisome (XPOF)

Valerii Apetroaiei

A Quick Take On Xponential Fitness

Xponential Fitness, Inc. (NYSE:XPOF) went public in July 2021, raising approximately $120 million in gross proceeds from an IPO that was priced at $12.00 per share.

The firm operates various fitness franchise brands in North America and overseas.

I previously wrote about XPOF in August 2022 with a Buy outlook.

While core customers may continue to pay for services, infrequent or “episodic” customers may have more difficulty paying for services that they view as discretionary and tangential or may wish to substitute with other options.

I remain Neutral [Hold] on Xponential Fitness, Inc. for the near term until we gain further visibility into the macroeconomic growth trajectory and its effect on consumer demand.

Xponential’s Overview And Market

Irvine, California-based Xponential Fitness was founded to create a fitness franchise business focused on the North American market.

Management is headed by founder and CEO Anthony Geisler, who previously purchased Club Pilates in 2015 and used that as the platform on which to create Xponential.

The company’s primary franchise studio offerings include:

-

Club Pilates.

-

Pure Barre.

-

Cyclebar.

-

StretchLab.

-

Row House.

-

YogaSix.

-

Rumble.

-

AKT.

-

Stride.

-

BFT.

The firm seeks well-capitalized franchisees who are entrepreneurial and energetic.

According to a 2021 market research report by Mordor Intelligence, the global health and fitness club market was an estimated $81 billion in 2020 and is forecast to grow at a CAGR (Compound Annual Growth Rate) of 7.21% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the benefit of health awareness and increasing incidence of obesity leading medical caregivers and governments to encourage exercise as a regular feature of individual habits.

Also, the North American region will continue to dominate the health and fitness center market in the coming years.

Major competitive or other industry participants by type include:

-

Full-service health clubs.

-

Other studio concepts.

-

Other sports clubs and activities.

-

At-home and digital fitness offerings.

Xponential’s Recent Financial Trends

-

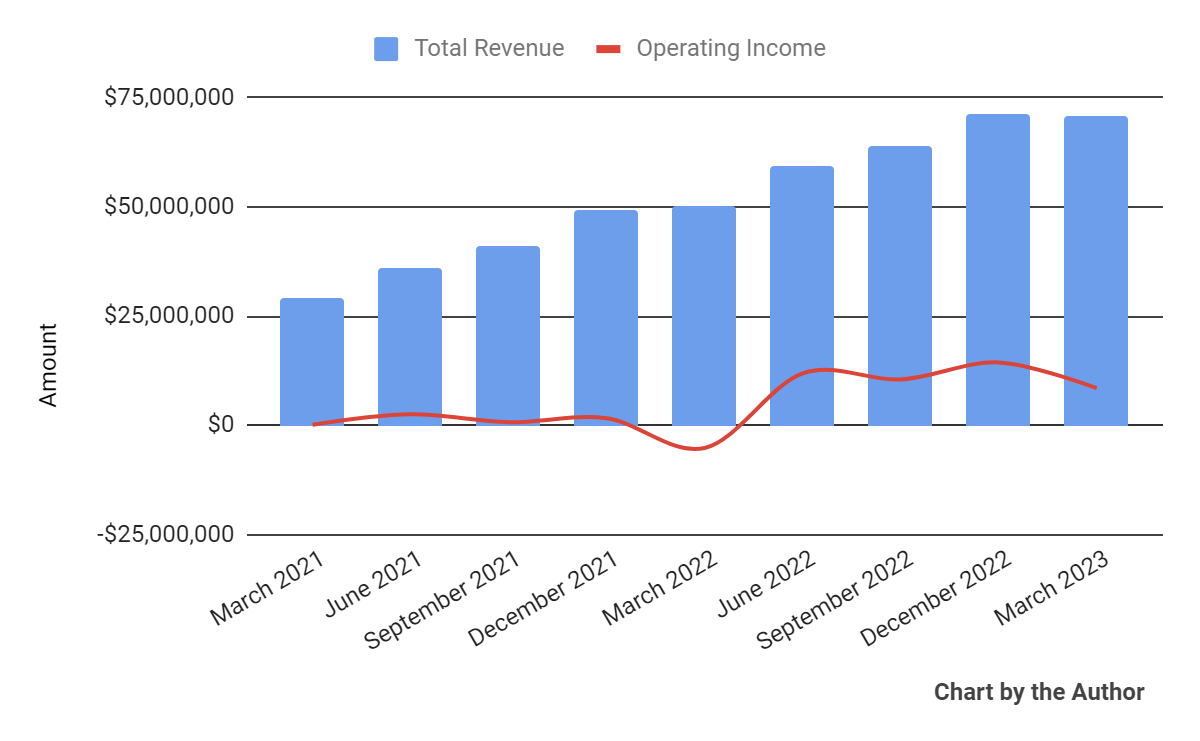

Total revenue by quarter has risen substantially; Operating income by quarter has plateaued.

Total Revenue and Operating Income (Seeking Alpha)

-

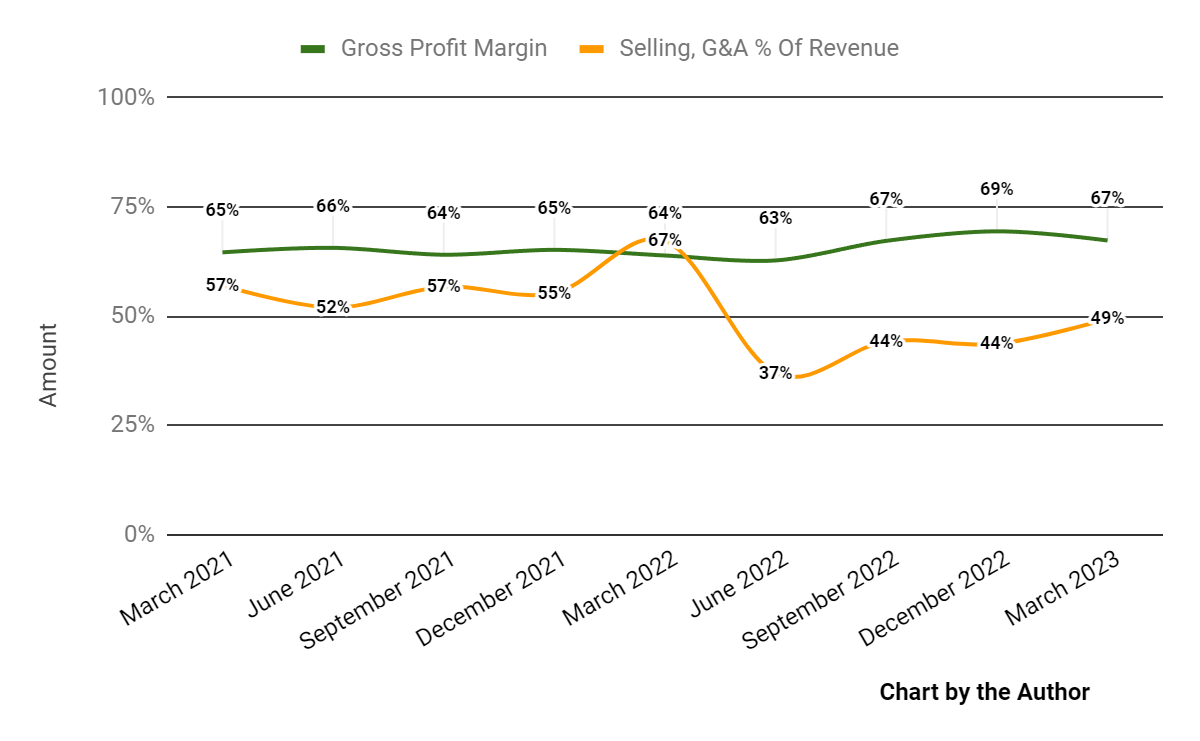

Gross profit margin by quarter has trended higher recently; Selling, G&A expenses as a percentage of total revenue by quarter have dropped.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

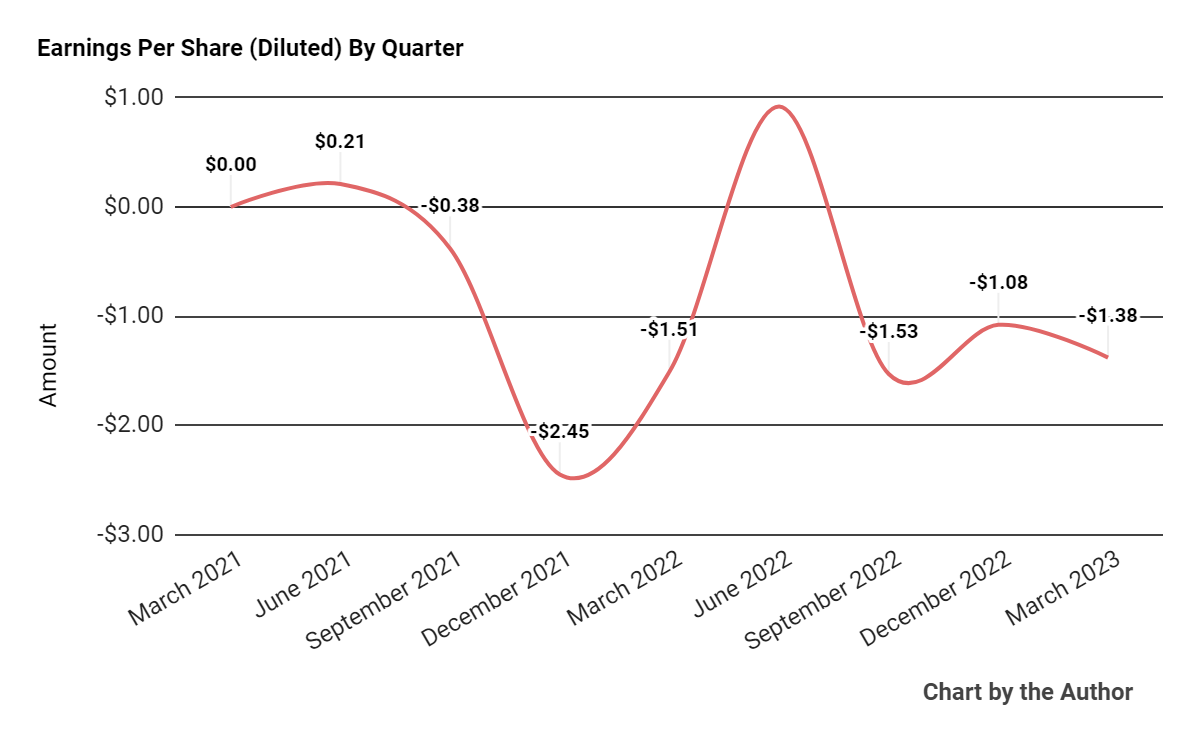

Earnings per share (Diluted) have produced high volatility in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP).

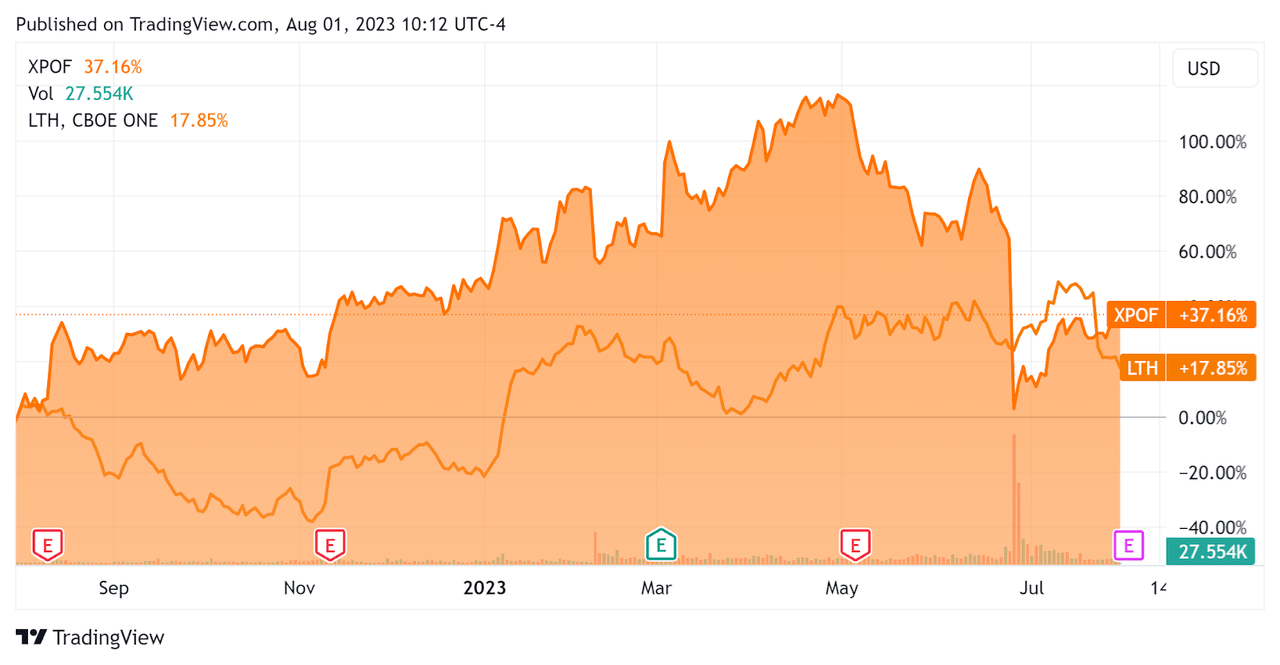

In the past 12 months, XPOF’s stock price has risen 37.16% vs. that of Life Time Group Holdings’ (LTH) growth of 17.85%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $22.2 million in cash and equivalents and $261.9 million in total debt, of which $4.3 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $50.8 million, and capital expenditures were $9.3 million. The company paid $19.9 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Xponential Fitness

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.3 |

|

Enterprise Value / EBITDA |

18.4 |

|

Price / Sales |

2.1 |

|

Revenue Growth Rate |

50.4% |

|

Net Income Margin |

-0.2% |

|

EBITDA % |

23.1% |

|

Net Debt To Annual EBITDA |

3.8 |

|

Market Capitalization |

$1,010,000,000 |

|

Enterprise Value |

$1,130,000,000 |

|

Operating Cash Flow |

$60,130,000 |

|

Earnings Per Share (Fully Diluted) |

-$3.07 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Life Time Group Holdings; shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

Life Time Group |

Xponential Fitness |

Variance |

|

Enterprise Value / Sales |

3.7 |

4.3 |

13.6% |

|

Enterprise Value / EBITDA |

19.8 |

18.4 |

-7.2% |

|

Revenue Growth Rate |

27.7% |

50.4% |

82.2% |

|

Net Income Margin |

4.1% |

-0.2% |

–% |

|

Operating Cash Flow |

$336,940,000 |

$60,130,000 |

-82.2% |

(Source – Seeking Alpha)

Commentary On Xponential Fitness

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the 24% year-over-year growth in the number of franchisees, now over 2,750 studios worldwide.

The firm has sold more than 5,600 licenses among its 10 fitness brands.

Same-store sales growth rose 20%, a material uptick sequentially from the 17% growth in the two previous quarters.

Notably, the leadership said that its franchisee prospects and existing franchisees have ample access to capital to fund their growth plans, although higher interest rates are a factor.

Management didn’t disclose any customer or revenue retention rate metrics.

Total revenue for Q1 2023 rose 40.3% year-over-year while gross profit margin increased 3.4%.

Selling, G&A expenses as a percentage of revenue dropped 17.9% YoY, indicating sharply improving efficiency and operating income rose to $8.5 million from a loss of $5.2 million a year earlier.

The company’s financial position is moderate, with limited cash liquidity, material debt but strong positive free cash flow.

Looking ahead, management guided full-year 2023 revenue to $295 million at the midpoint of the range, or a growth rate of about 20.4% over 2022.

If achieved, this would represent a decline in revenue growth versus 2022’s growth rate of 57.93% over 2021, indicating a moderating growth trajectory.

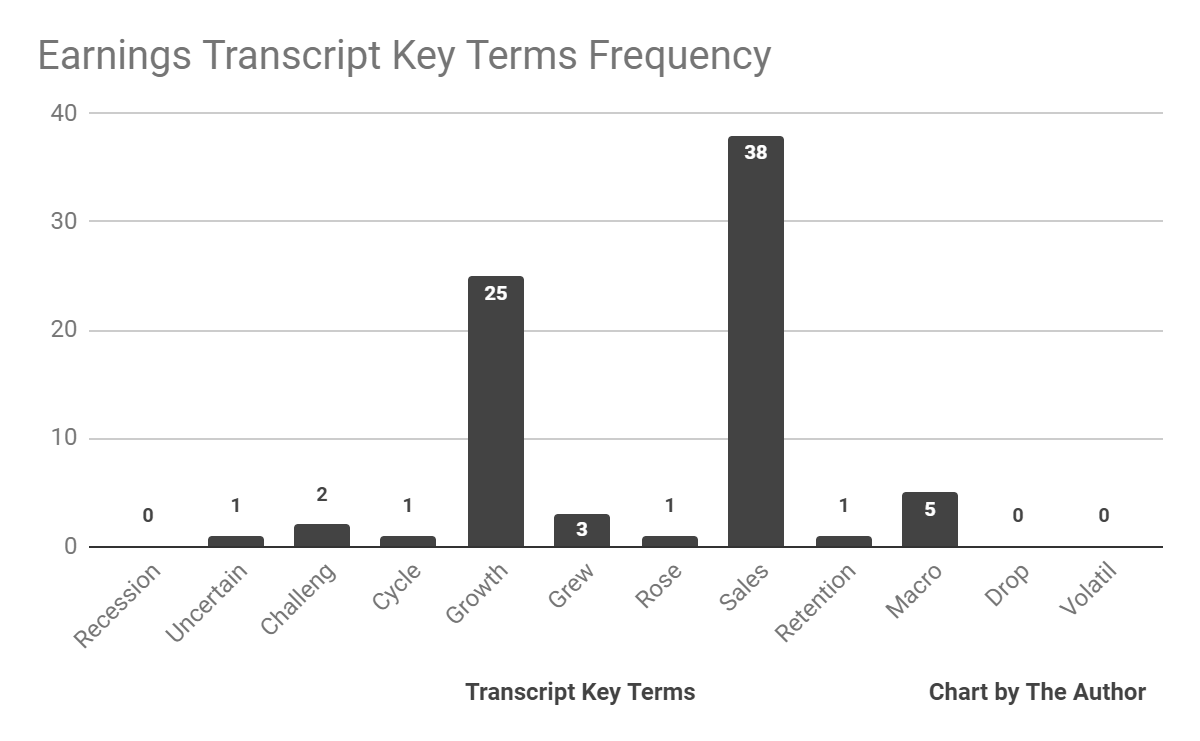

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” once, “Challeng[es][ing]” two times, and “Macro” five times.

Analysts questioned company leadership about studio opening cadence, to which management said that the rise in interest rates affects the large units more than the small units and sees steady domestic business openings coupled with a rise in international activity over time.

Regarding valuation, in the past twelve months, the firm’s EV/Sales valuation multiple has risen by 9.9%, as the chart from Seeking Alpha shows below.

EV/Sales Multiple History (Seeking Alpha)

The stock has been the target of a recent short seller report questioning the health of franchisee financial results and other metrics. The report resulted in a sharp stock drop in response.

Analyst firm Evercore ISI followed up with its own defense of the firm’s fundamentals and the stock has risen unevenly since that response.

A potential upside catalyst to the stock could include further normalization back to pre-short-seller report levels.

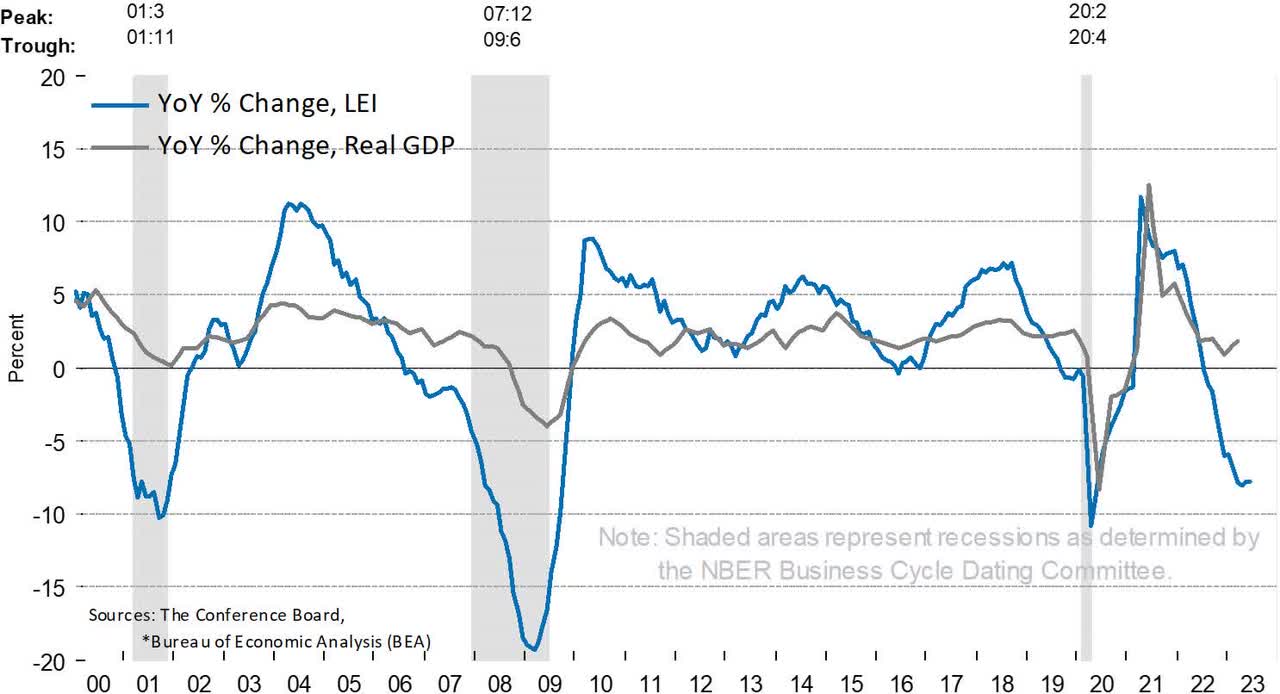

However, economic leading indicators continued to fall in June, according to The Conference Board’s index.

The index’s history from 2000 to the present quarter shows the periods of recession in vertical gray areas against the lines of real GDP change (gray line) and the leading economic indicators index (blue line) in the chart below.

Index Of Leading Economic Indicators (The Conference Board)

So, with leading economic indicators remaining well into negative territory, I’m cautious about the economic outlook and the stock market’s direction in the near term.

Also, with a softening economy, access to capital for franchisees may become more constrained as lenders pull back or increase pricing to account for increased risk.

Additionally, while core customers may continue to pay for services, infrequent or “episodic” customers may have more difficulty paying for services that they view as discretionary and tangential or may wish to substitute with other options.

As such, I’m Neutral [Hold] on Xponential Fitness, Inc. for the near term until we gain further visibility into the macroeconomic growth trajectory and its effect on consumer demand.